Commercial names:

Digital, Cash Collect Protection

Characteristics

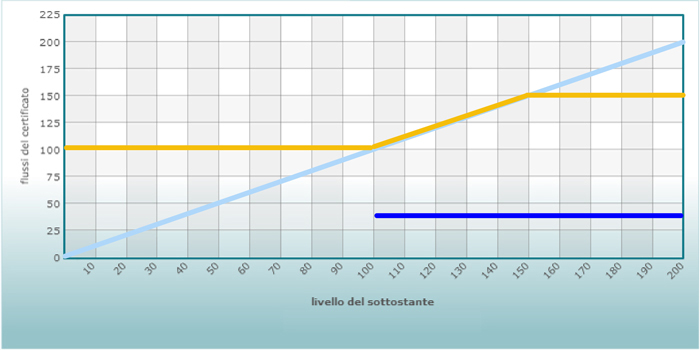

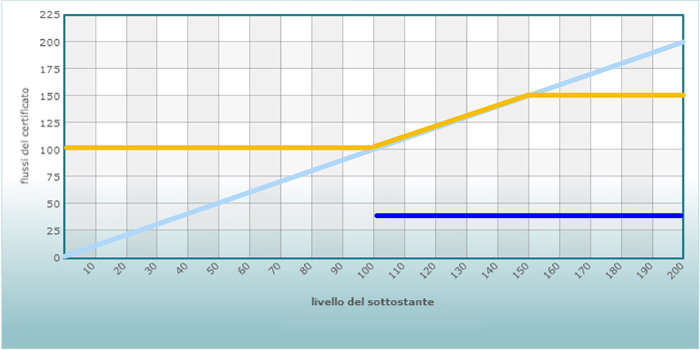

- Full or partial capital protection

- Periodic proceeds during the life of the certificate (paid if the underlying asset’s value is equal or higher than a pre-arranged reference value)

- Premium at maturity if the underlying asset’s value is higher than or equal to the strike price

Return profiles

| Maturity | 3 - 6 years |

| Investment horizon | Mid/long term |

| Aim | To obtain profits from small upward movements of the underlying asset’s price, with full or partial capital protection |

| Strategy | Bullish |

Capital protection at maturity/risk | In case of downward movements of the underlying asset’s price, capital protection is up to 100%. |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

Commercial names:

Digital Barrier Plus , Athena Protezione

Characteristics:

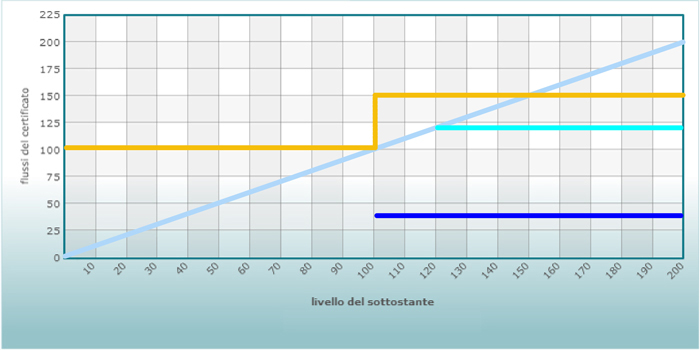

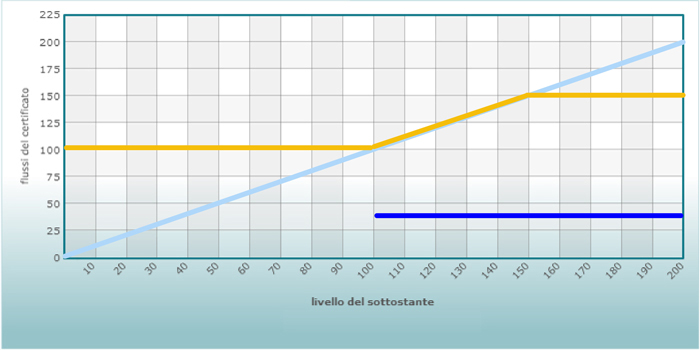

- Early redemption of a pre-arranged amount in case the underlying asset’s price is higher than or equal to a certain level on pre-arranged dates.

- Full or partial capital protection

- Periodic proceeds during the life of the certificate (paid if the underlying asset’s value is equal or higher than a pre-arranged reference value)

- Premium at maturity if the underlying asset’s value is higher than or equal to the strike price

Return profiles

| Maturity | 3 - 6 years |

| Investment horizon | short/mid term (or long term, in case of no early redemption) |

| Aim | To obtain profits from stability, small upward or downward movements of the underlying asset’s price, through a quick reimbursement with additional premium / to obtain proceeds from small upward movements of the underlying asset’s price |

| Strategy | Bullish |

| Capital protection at maturity/Risk | In case of downward movements of the underlying asset’s price, capital protection is up to 100% |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement component.

Performance drivers

| Variables | Issue | Barrier** | Life residual*** |

Rainbow

Commercial names

Digital, Cash Collect Protection

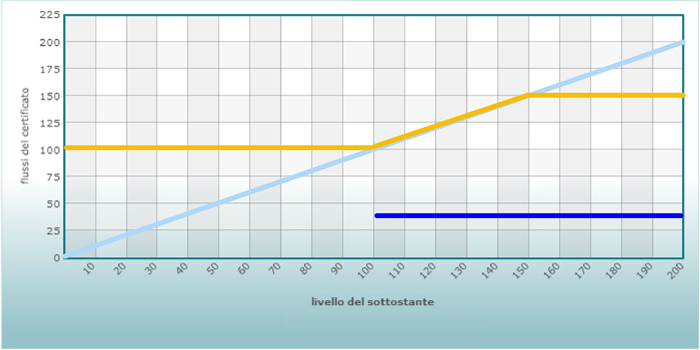

Characteristics:

- Early redemption with additional premium, in case the underlying asset’s price is higher than or equal to a pre-arranged level on certain dates

- Full or partial capital protection

- Periodic proceeds during the life of the certificate (paid if the underlying asset’s value is equal or higher than a pre-arranged reference value)

- Premium at maturity if the underlying asset’s value is higher than or equal to the strike price

- Underlying asset consisting in a basket of securities (present in proportions linked to their performances)

Return profiles

| Maturity | 3 - 4 years |

| Investment horizon | mid/long term |

| Aim | To obtain proceeds from small upward movements of the underlying asset’s price, with full or partial capital protection |

| Strategy | Bullish |

| Capital protection at maturity/Risk | In case of downward movements of the underlying asset’s price, capital protection is up to 100% |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates

Features

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement component.

Performance drivers

| Variables | Issue | Barrier** | Life residual*** |

Commercial names

Digital, Cash Collect Protection

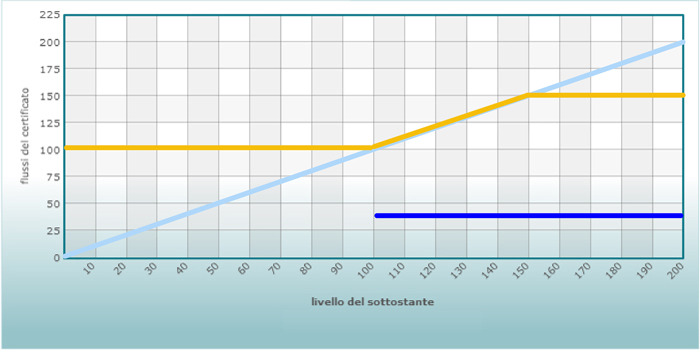

Characteristics

- Underlying asset consisting in a basket of securities or indexes, among which the best performing one determines the performance of the certificate

- Full or partial capital protection

- Periodic proceeds during the life of the certificate (paid if the underlying asset’s value is equal or higher than a pre-arranged reference value)

- Premium at maturity if the underlying asset’s value is higher than or equal to the strike price

Return profiles

| Maturity | 3 - 6 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds from small upward movements of the underlying asset’s price, with full or partial capital protection |

| Strategia | Bullish |

| Capital protection at maturity/Risk | In case of downward movements of the underlying asset’s price, capital protection is up to 100% |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement component.

Performance drivers

| Variables | Issue | Barrier** | Life residual*** |

Commercial names

Digital, Cash Collect Protection

Characteristics:

- Underlying asset consisting in a basket of securities or indexes, among which the worst performing one determines the performance of the certificate

- Full or partial capital protection

- Periodic proceeds during the life of the certificate (paid if the underlying asset’s value is equal or higher than a pre-arranged reference value)

- Premium at maturity if the underlying asset’s value is higher than or equal to the strike price

Return profiles

| Maturity | 3 - 6 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds from small upward movements of the underlying asset’s price, with full or partial capital protection |

| Strategy | Bullish |

| Capital protection at maturity/Risk | In case of downward movements of the underlying asset’s price, capital protection is up to 100% |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement component.

Performance drivers

| Variables | Issue | Barrier** | Life residual*** |

Commercial names

Digital, Cash Collect Protection

Characteristics

- Full or partial capital protection

- Periodic proceeds during the life of the certificate (paid if the underlying asset’s value is equal or higher than a pre-arranged reference value)

- Premium at maturity if the underlying asset’s value is higher than or equal to the strike price

- Cap on potential returns

Return profiles

| Maturity | 3 - 5 years |

| Investment horizon | Mid term |

| Aim | To obtain proceeds from small upward movements of the underlying asset’s price, with full or partial capital protection |

| Strategy | moderately bullish |

| Capital protection at maturity/Risk | In case of downward movements of the underlying asset’s price, capital protection is up to 100% |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement component.

Performance drivers

| Variables | Issue | Barrier** | Life residual*** |

Commercial names

Digital Standard Short

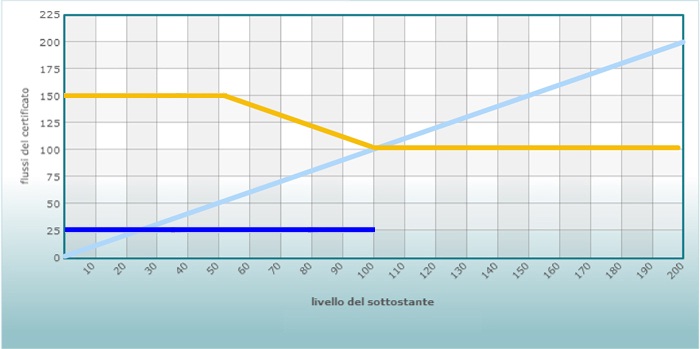

Characteristics

- Full or partial protection

- Periodic proceeds during the life of the certificate (paid if the underlying asset’s value is equal or higher than a pre-arranged reference value)

- Premium at maturity if the underlying asset’s value is higher than or equal to the strike price

Return profiles

| Maturity | 3 - 6 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds from small downward movements of the underlying asset’s price, with full or partial capital protection |

| Strategy | Bearish |

Capital protection at maturity/Risk | In case of upward movements of the underlying asset’s price, capital protection is up to 100% |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement, participation to downward movements of the underlying asset’s price.

Performance drivers

| Variables | Issue | Barrier** | Life residual*** |