Standard

Commercial names

Cash Collect, Digital

Characteristics:

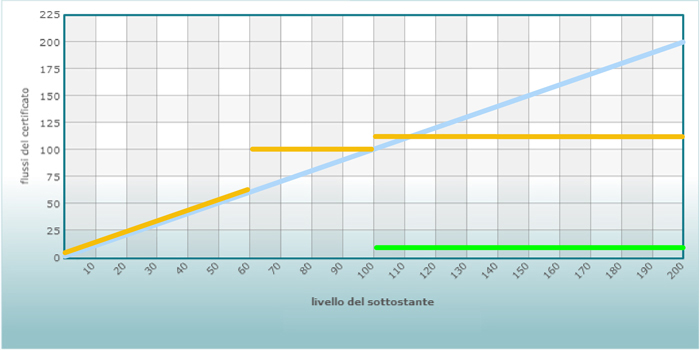

- Periodic proceeds during the certificate’s life and at maturity if the underlying asset’s price has been higher than or equal to a certain level on the observation dates

- Barrier for capital protection

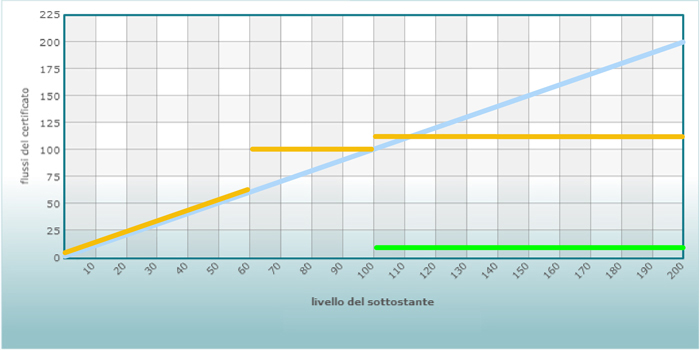

Return profiles

| Maturity | 3 - 5 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

Features

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

Autocallable

Commercial names

Cash Collect Autocallable

Characteristics:

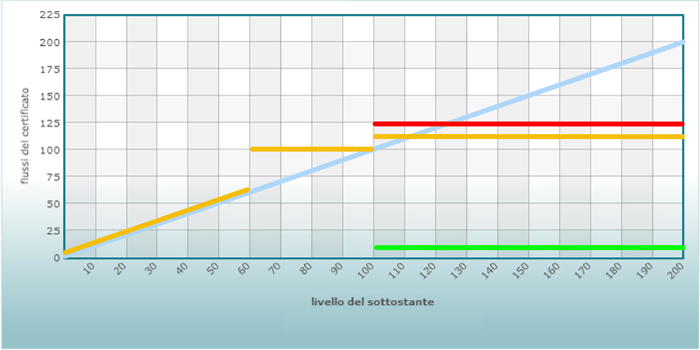

- Chance to obtain early redemption with an additional premium on certain dates if the underlying asset’s price is higher than or equal to a pre-arranged level

- Barrier for capital protection

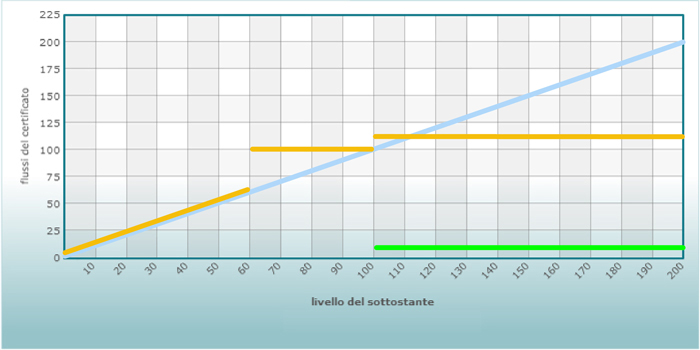

Return profiles

| Maturity | 1.5 - 5 years |

| Investment horizon | Short term (or mid/long term, in case of no early redemption) |

| Aim | To profit from stability, small upward or small downward movements of the underlying asset’s price, obtaining early redemption and premium / to obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement component.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component, early reimbursement component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

American Barrier

Commercial names

Cash Collect

Characteristics:

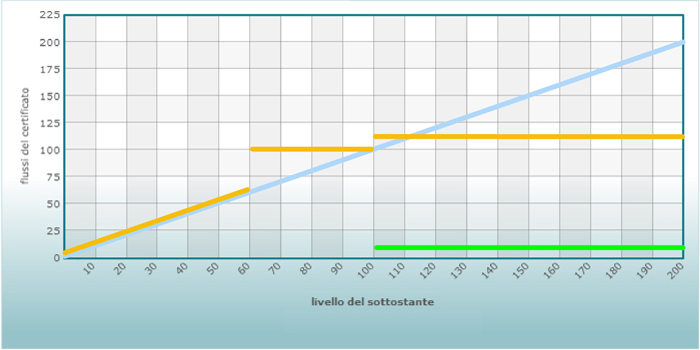

- Periodic proceeds during the certificate’s life and at maturity if the underlying asset’s price has been higher than or equal to a certain level on the observation dates

- Barrier for capital protection (relevant all throughout the life of the instrument)

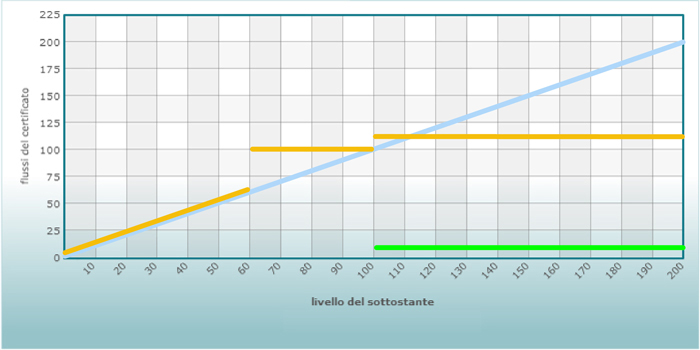

I profili di rendimento

| Maturity | 3 - 5 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

European Barrier

Commercial names

Cash Collect

Characteristics:

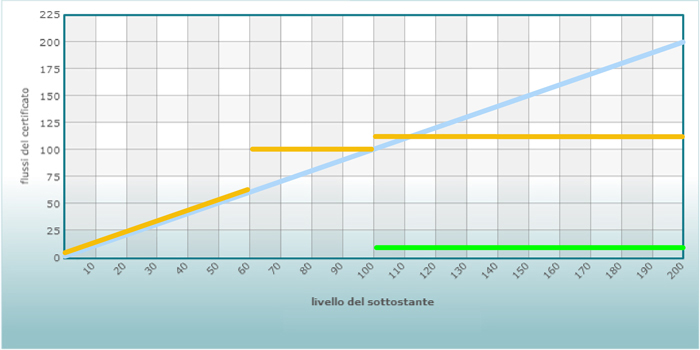

- Periodic proceeds during the certificate’s life and at maturity if the underlying asset’s price has been higher than or equal to a certain level on the observation dates

- Barrier for capital protection (relevant only at maturity)

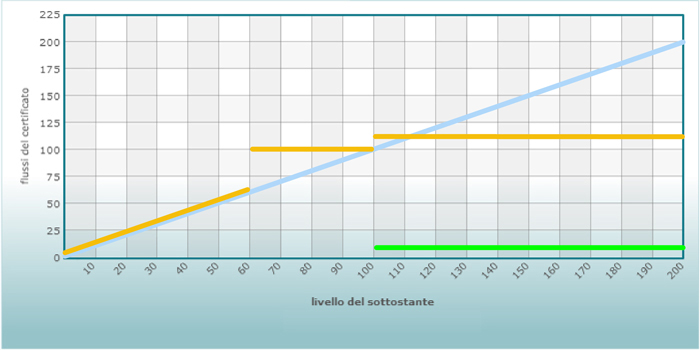

Return profiles

| Maturity | 3 - 5 years |

| Investrment horizon | Mid/long term |

| Aim | To obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

Worst Of

Commercial names

Cash Collect

Characteristics:

- Periodic proceeds during the certificate’s life and at maturity if the underlying asset’s price has been higher than or equal to a certain level on the observation dates

- Barrier for capital protection (relevant only at maturity)

- Underlying asset consisting in a basket of securities, among which the worst-performing one determines the overall performance of the certificate

Return profiles

| Maturity | 3 - 5 years |

| Investment horizon | Mid/logn term |

| Aim | To obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

Best Of

Commercial names

Cash Collect, Digital

Characteristics:

- Periodic proceeds during the certificate’s life and at maturity if the underlying asset’s price has been higher than or equal to a certain level on the observation dates

- Barrier for capital protection (relevant only at maturity)

- Underlying asset consisting in a basket of securities, among which the best-performing one determines the overall performance of the certificate

Return profiles

| Maturity | 3 - 5 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

Commercial names

Cash Collect, Digital

Characteristics:

- Periodic proceeds during the certificate’s life and at maturity if the underlying asset’s price has been higher than or equal to a certain level on the observation dates

- Barrier for capital protection (relevant only at maturity)

- Underlying asset consisting in a basket of securities, present in proportions linked to their performances

Return profiles

| Maturity | 3 - 5 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |

Cap

Commercial names

Cash Collect, Digital

Characteristics:

- Periodic proceeds during the certificate’s life and at maturity if the underlying asset’s price has been higher than or equal to a certain level on the observation dates

- Barrier for capital protection (relevant only at maturity)

- Cap on potential returns

Return profiles

| Maturity | 3 - 5 years |

| Investment horizon | Mid/long term |

| Aim | To obtain proceeds even in presence of downward movements of the underlying asset’s price |

| Strategy | Moderately bullish, in case the underlying asset’s price does not reach the barrier level on observation dates Bullish, in case the underlying asset’s price reaches the barrier level on observation dates |

| Capital protection at maturity/Risk | Capital protection at maturity up to a pre-arranged barrier level. Full replication of the downward price movements of the underlying asset in case the underlying asset’s price has been lower than or equal to the barrier level during the life of the certificate |

Learn more

Investment certificates are financial products characterized by a number of features. They may simply replicate the underlying asset’s upward movements or downward movements, or they may be structured so as to implement more sophisticated strategies, which may include total or conditional capital protection against bad performances of the underlying asset (protection component).

Some certificates’ characteristics may also allow the owners to obtain proceeds during the life of the certificate, under condition that specific events take place (income component). A premium may be paid at maturity under form of additional proceeds in case the underlying asset’s price does not drop under the barrier (this is the case, for example, of bonus certificates).

The return on investment in some typologies of certificates may be determined by both the changes in the underlying asset’s price and the absence of such price movements for a timespan shorter than the life of the contract (early reimbursement component). These certificates pay a sort of premium for early redemption in case the underlying asset’s price is above a certain level on pre-arranged dates.

Moreover, some certificates feature an additional element, useful in periods of strong fluctuations of exchange rates – a protection against unfavourable changes in currency value. Products offering such protection, called “Quantum”, make it possible to invest in underlying asset’s denominated in a foreign currency avoiding exposure to the risks linked to exchange rates.

Features

The certificates’ payoff characteristics imply the following components: protection component, income component.

Performance drivers

Reactivity of the certificates’ prices to changes in key variables.

| Variables | Issue | Barrier** | Life residual*** |